Steering a business in Singapore’s vibrant marketplace means mastering many arts, and ensuring smooth, hassle-free payments is definitely one of them. That little machine on your counter, the payment terminal, is more than just hardware; it’s a crucial touchpoint for your customers and a key component of your operational efficiency. But faced with a bustling arena of providers – agile fintechs like Fiuu and Hitpay, the established national player NETS, specialized services like Diners Club Singapore (DCS), and the familiar banking giants DBS, UOB, and OCBC – how do you choose the right champion for your checkout?

It’s about looking beyond the surface and understanding how different options align with the unique rhythm and needs of your businesses. Let’s explore the critical factors.

Comparative Analysis of Offline Payment Gateway Terminals

To facilitate a clear comparison, the following tables summarize the key aspects of the offline payment gateway terminals offered by Fiuu, DCS, Hitpay, NETS, and the representative banks (DBS, UOB, OCBC).

- Cost and Fees Comparison:

| Feature | Fiuu | DCS | Hitpay | NETS | DBS | UOB (via NETS) | OCBC |

| Terminal Purchase/Rental Fee | Zero Rental Cost | Zero Rental Cost | Purchase (S$ 80-500 depends on models) | Subscription (S$38/month + add-ons) | Purchase (S$302/year for A50) / Rental options | Subscription (S$38/month + add-on S$12/month) | Purchase (cost not specified) |

| Setup Fee | Free | S$ 450-600 | Self Setup | S$60 | S$300 (for some terminals) | Included in subscription | None (for OneCollect) |

| Other Potential Fees | Security Deposit (S$200) may applies | Yearly service fee S$ 360-450, for print roll delivery, servicing | Pay-per-transaction only | Deposit (S$200), Telco (S$10/month), Early Termination (S$30) | Annual fee (S$240 for some), Deposit for some | Deposit (S$200), Telco (S$10/month), Early Termination (S$30) | None (for OneCollect) |

- MDR Rate Comparison (Selected Payment Methods):

| Payment Method | Fiuu | DCS | Hitpay | NETS | DBS | UOB (via NETS) | OCBC |

| NETS/Debit Card | Not specified | Not specified | Not applicable | 0.8% | Not applicable | 0.8% | Not applicable |

| Credit Card (Visa/MC) | 2.40% | Competitive Pricing | 2.5% (Domestic) | 2.99% | 2.50% – 3.00% | 2.99% | 2.50% – 3.00% |

| QR Code (e.g., PayNow) | 0.50% | Supported | 0.65% (Min S$0.1) | Supported | 0.50% | Supported | 0.50% |

| E-Wallet (e.g., GrabPay,Alipay, Wechat) | 1.30% – 2.00% | Supported | 2.2% | Supported | Supported | Supported | Supported |

- Virtual Terminal Feature Comparison:

| Feature | Fiuu | DCS | Hitpay | NETS | DBS | UOB (via NETS) | OCBC |

| Availability | Mobile App (Virutal Terminal), Online Merchant Portal, Payment Links, Invoicing | Online Merchant Portal (Reconciliation) | Online Merchant Portal, Payment Links, Invoicing | SimplyNETS Lite (QR), NETS Click (In-App), eNETS Debit (Online), NETS QR Online | Hosted Payment Page, URL Payment Link, Online MOTO, DBS MAX Portal, Virtual Account | NETS Click (In-App), eNETS Debit (Online), Temporary Terminal Request | OCBC OneCollect (QR), Virtual Purchasing Card, Virtual Payment Terminal (Online MOTO) |

| Supported Payment Methods | Credit Card, E-Wallet, PayNow, Crypto, Tap-On-Phone, Online Banking, Payment Link/Bills | Credit Card, E-Wallet, PayNow, Crypto | Major Credit/Debit Cards, E-Wallets, PayNow, etc. | NETS Bank Card, NETS-enabled Credit Card, Internet Banking, Local Bank Apps | Installment Plans, PayLah!, Cards, URL Payment Link, Multi-currency, Contactless, Mobile, Online MOTO | Tokenized NETS Bank Card, Internet Banking | PayNow, Alipay+, WeChat Pay, UnionPay, ShopeePay, DuitNow QR, Cards (via MOTO) |

| Key Features | Customizable Links, On-the-go, Security, Scalability, Instant Alerts, Tap-On-Phone | Reconciliation, Cardholder Account Management (D-Vault) | Customizable Links, Recurring Payments, Branded Checkout, Invoicing | QR Payments, In-App Payments, Online Payments | Reconciliation, Refunds, Multi-currency, Recurring Payments, Card on File, Installment Plans | In-App Payments, Online Payments | QR Payment Collection, Real-time Notifications, Reporting, Multi-channel Sharing, Recurring, Invoicing |

- Physical Terminal Feature Comparison:

| Feature | Fiuu | DCS | Hitpay | NETS | DBS | UOB (via NETS) | OCBC |

| Terminal Type | Portable | EDC Terminal | Integrated POS Terminal, POS Max | Wired, Wireless, Unified POS | A50 POS, All-in-One Retail Terminal | NETS POS Terminal, Unified POS Terminal | Card Terminal |

| Supported Payment Methods | Cards, E-Wallets, Buy Now Pay Later, Paywave, Swipe Card, Insert Card, scan Alipay/wechat QR | Major Credit/Debit Cards, E-Wallets, QR Codes, Paywave | Cards (Credit/Debit, Contactless), QR, Digital Wallets | NETS Debit/ATM, NETS FlashPay, NETS Prepaid, NETS QR; Unified: + Int’l Cards, Overseas Wallets | QR PayNow, Credit Cards, Contactless, Mobile Payments | NETS Debit/ATM, FlashPay, Prepaid, QR; Unified: + Int’l Cards, Overseas Wallets | VISA, MasterCard, UnionPay, JCB, Alipay+ QR, WeChat Pay QR, PayNow QR, EZ-link, Contactless, Mobile Payments |

| Connectivity Options | Multi-Network SIM Card, Wi-Fi | Not specified | Wi-Fi, 4G, Bluetooth | Wired (Phone/LAN), Wireless (Mobile Data/Wi-Fi) | Wired, Wi-Fi | Wired, Wireless (Mobile Data) | Wired, Wi-Fi |

| Reporting Capabilities | Online Merchant Portal / | Online Merchant Portal | Transaction History & Reporting | NETS Merchant Portal | DBS MAX Portal (via IDEAL) | NETS Merchant Portal | OCBC OneCollect App |

| Unique Features | Offline Processing, Additional Revenue Stream (Reloads, Bill Payments) | Zero Terminal Rental Cost | Integrated POS Features (Inventory, Sales Tracking), POS Max (All-in-One Device) | Wide User Base (NETS), Accepts Foreign Cards/Wallets | Installment Payment Plans, Dynamic Currency Conversion | Access to NETS User Base, Accepts Foreign Cards/Wallets (Unified) | Preferential Pricing for OCBC Cardholders, Interest-Free Installment Plans |

Unpacking the Costs: More Than Just a Monthly Fee

Naturally, budget is a major consideration, but the true cost involves several layers. The physical terminal itself comes with varying price structures. DCS makes a bold statement by offering zero rental cost for its terminals, a potentially significant saving for businesses watching their overheads closely. On the other hand, NETS operates primarily on a monthly subscription model, typically around S$38, though promotions like UOB’s BizSmart offer might provide initial free months. Banks often present a mix; DBS, for instance, offers its MAX A50 terminal with an annual fee (sometimes discounted for new sign-ups) and also provides rental options for more comprehensive terminals, albeit with potential setup fees. Fintechs like Hitpay and Fiuu provide payment gateway terminals at zero cost or a one-time purchase cost. Don’t forget potential extras like refundable security deposits, particularly for wireless terminals from providers like NETS and Fiuu, or possible one-time installation and ongoing telco fees for connectivity.

Fiuu does offer a mobile app called Fiuu Virutal Terminal which can be installed on mobile phone with NFC feature to accept payment for credit card, PayNow, and all kinds of e-wallets such as grabpay, shopeePay, wechat pay, Alipay, etc.

Beyond the hardware, the Merchant Discount Rate (MDR) – that small percentage fee skimmed off each transaction – significantly impacts your bottom line. These rates fluctuate based on the payment method. For the ubiquitous PayNow QR code payments popular in Singapore, OCBC OneCollect and the DBS MAX App offer notably low MDRs, around 0.50%, with OCBC even waiving this for the first few months for SMEs. Hitpay also presents a very competitive 0.65% for PayNow transactions. If your customer base heavily relies on NETS debit cards linked to local bank accounts, using a NETS terminal (directly or via UOB) provides an attractive 0.8% MDR.

Credit card transactions typically incur higher rates, often ranging from 2.5% to 3.0% or more. Hitpay clearly lists its domestic card rate at 2.5% (slightly lower for F&B) and international at 3.2%. DBS quotes rates between 2.50% and 3.00%, sometimes varying for retail versus service businesses, and offers specific rates for installment plans. The NETS Unified POS terminal, designed to accept credit cards alongside NETS, carries a rate closer to 2.99%. Fiuu’s Malaysian online rates suggest a similar range, but Singapore-specific offline rates require direct confirmation. DCS promotes “Competitive Pricing” but doesn’t publicly list its MDRs. Understanding the mix of payment types your customers prefer is vital to accurately forecasting these transaction costs.

Getting Up and Running: The Application Journey

Once you’ve weighed the costs, consider the onboarding process. Fintech providers like Hitpay and Fiuu often emphasize streamlined digital applications, promising quick setup times, sometimes allowing merchants to start accepting payments rapidly. This speed can be a significant advantage for businesses eager to get operational. Traditional banks, including DBS, UOB, and OCBC, typically require you to hold a business account with them as a prerequisite for merchant services. While this might involve an extra step for new customers, it can simplify integration for existing clients, with platforms like DBS IDEAL offering instant sign-up for certain services. NETS provides an online application route but necessitates submitting specific business documents (like ACRA details and bank statements, preferably from DBS, OCBC, or UOB) and arranging for terminal collection from their office. Applying for DCS services generally starts with a phone call or filling out an online interest form.

Functionality Focus: Matching Features to Your Workflow

What capabilities do you truly need from your payment system? The rise of virtual solutions offers flexibility beyond the physical counter. Many providers now enable remote payments. Hitpay offers versatile Payment Links that can be easily shared online or via messages, allowing customization and recurring payment options. DBS provides similar URL payment links alongside hosted payment pages and Mail Order/Telephone Order (MOTO) processing capabilities. Fiuu’s VT mobile application aims to transform a smartphone into a comprehensive payment terminal supporting various methods. OCBC’s OneCollect app focuses on streamlining QR payment collection from multiple sources directly to a mobile device. NETS also offers virtual options like NETS Click for in-app payments and eNETS Debit for online bank transfers.

For in-person transactions, the physical terminals themselves vary. Basic models might focus primarily on NETS and card payments, while more advanced units, like the NETS Unified POS or bank terminals from DBS and OCBC, readily accept a wider array of international cards, contactless payments (like Visa payWave and Mastercard PayPass), mobile wallets (including Apple Pay, Samsung Pay, Google Pay), and QR codes. Some terminals integrate broader Point of Sale (POS) functionalities; Hitpay’s terminals, for example, can include inventory management and sales tracking, with their POS Max device combining multiple hardware functions. Fiuu highlights its terminals’ ability to process offline payments if connectivity drops and even offer value-added services like mobile reloads, potentially creating an additional revenue stream. Banks like DBS and OCBC often facilitate interest-free installment plans directly through their terminals for their own credit cardholders. Connectivity options range from wired LAN connections to wireless setups using Wi-Fi or mobile data via SIM cards, with Fiuu mentioning multi-network SIMs for enhanced reliability. Reliable reporting is also key, with most providers offering online portals (like DBS MAX Portal, NETS Merchant Portal, DCS Online Merchant Portal) or app-based reporting (OCBC OneCollect) for transaction tracking and reconciliation.

Aligning with Your Audience and Operations

The “best” terminal ultimately depends on who your customers are and how you operate. If your business primarily serves the local Singaporean market using debit cards for everyday purchases, NETS offers unmatched reach and familiarity, with its low debit MDR being a significant plus. Businesses catering to tourists or a clientele favouring credit cards will need terminals capable of handling international schemes like Visa, MasterCard, AMEX, and JCB – capabilities offered by bank terminals, the NETS Unified POS, and fintechs like Hitpay and Fiuu. DCS remains a specific choice, potentially valuable in sectors like travel or high-end dining where Diners Club cards have a stronger presence, especially appealing due to its lack of rental fees. Consider also any operational restrictions: banks and Fiuu prohibit minimum spends or surcharges on credit card payments, NETS requires using their supplied SIM cards for wireless terminals, and UOB has specific industry prohibitions.

The Final Decision: A Tailored Choice

Choosing an offline payment terminal in Singapore isn’t a one-size-fits-all decision. It requires a careful assessment of your specific circumstances. For SMEs prioritizing simplicity, transparent costs, and perhaps integrated POS features, Fiuu & Hitpay present a compelling package with its clear pay-per-transaction model. Businesses with high NETS debit volume will likely find NETS terminals (directly or via UOB) highly efficient. If the convenience of integrated banking and payment services appeals, and perhaps features like installment plans are beneficial, exploring the offerings from your existing bank (DBS, UOB, or OCBC) is worthwhile. For those laser-focused on minimizing hardware costs, DCS’s zero-rental model is unique, assuming its card acceptance profile fits. And for businesses seeking feature-rich terminals with potential add-on services and strong virtual capabilities, Fiuu is a considerable contender.

Evaluate your typical transaction volumes, the payment methods your customers prefer, your budget for both hardware and ongoing fees, and your need for specific features like virtual terminals or POS integration. By understanding the nuances of each provider’s offering, as detailed in comparative analyses, you can select a payment partner that not only processes transactions reliably but truly supports your business’s growth and success in Singapore’s dynamic landscape. Sources and related content

]]>What’s This All About?

If you’re running a business in Singapore, you’ve probably noticed how quickly we’re moving toward a cashless society. E-commerce is booming, and customers expect smooth, hassle-free payment options when shopping online. But with so many payment gateways to choose from, how do you know which one is right for your business?

I’ve taken a deep dive into five popular payment gateways available in Singapore—Fiuu Pay, Hitpay, Airwallex, Stripe, and PayPal—to help you make an informed decision. Let’s break down what each has to offer.

The Quick Rundown

Before we dive into the details, here’s a snapshot of each gateway:

- Fiuu Pay (formerly Razer Merchant Services): Strong in Southeast Asia with tons of local payment methods

- Hitpay: Clear pricing and super user-friendly, especially for small businesses

- Airwallex: Excellent for handling multiple currencies and global transactions

- Stripe: Developer-friendly with powerful customization options

- PayPal: Globally recognized brand with a massive user base

Let’s Talk About Fiuu Pay

What’s the deal with Fiuu Pay?

Fiuu Pay (previously known as Razer Merchant Services) is a payment gateway focused on Southeast Asia. If you’re targeting customers in Malaysia, Singapore, Indonesia, Philippines, Vietnam, and Thailand, this one’s worth considering. They rebranded from Razer Merchant Services in March 2024, now operating as an independent subsidiary of Razer Inc.

The costs

Fiuu Pay offers tiered pricing with Lite and Premium packages. The Premium package includes credit/debit card processing at 2.4%, for common merchants, the local card processing fee is 2.8%, without the usual 0.5 SGD fixed transaction fee, e-wallet processing at rates between 1.5% and 1.7%, also without the 0.50 SGD fixed transaction fee, and various Buy Now Pay Later options. If you are building a website and want to integrate Fiuu Pay, you may consider Vue Tech SG.

What currencies can I use?

They support several currencies including SGD, PHP, IDR, VND, THB, AUD, DKK, CHF, USD, and MYR—giving you good coverage for Southeast Asian markets.

What payment methods do they accept?

This is where Fiuu Pay really shines. They support over 110 payment methods across Southeast Asia, including:

- Cards: Mastercard, VISA, Diners Club, JCB, UnionPay

- Digital wallets: Apple Pay, Samsung Pay, Google Pay, Huawei Pay

- Internet banking: PayNow, DBS, OCBC, UOB, and other major banks

- E-wallets: GrabPay, Shopee Pay, Alipay, WeChat Pay

- Even cryptocurrencies like Bitcoin and Ethereum

How easy is it to set up?

Fiuu Pay offers plugins for platforms like Shopify, Woocommerce, and SiteGiant. API documentation for custom integrations, and a “Mobile XDK” for mobile applications. They also provide a Telegram developer forum for support.

Is it secure?

Yes—they’re PCI DSS Service Provider Level 1 compliant and have ISO 27001:2022 certification. They use tokenization to replace sensitive card details and claim to have one of the lowest dispute transaction ratios in the industry.

What about support?

Technical support is available via email at [email protected], and they offer dedicated account managers for business clients.

How do I get my money?

Clients can select daily or weekly settlement, the settlement fee can be waived under certain conditions.

Looking at Hitpay

What’s Hitpay all about?

Hitpay focuses on providing all-in-one payment solutions for small and medium-sized businesses in Singapore and the APAC region. Their website is hitpayapp.com/sg/.

The costs

Hitpay uses a transparent pay-per-transaction model with no subscription or hidden fees. For online payments, rates range from 0.65% + S$0.30 for PayNow (for transactions ≥ S$100) to 5.5% for various Buy Now Pay Later options, the local card payment fee is 2.8% + 0.50 SGD. The in-person payments are generally cheaper, with rates like 2.5% for domestic cards and 0.4% for PayNow. They also offer custom pricing for high-volume businesses.

What currencies can I use?

Hitpay supports more than 150 currencies, including SGD, IDR, MYR, VND, PHP, THB, INR, CNY, and AUD.

What payment methods do they accept?

They support over 50 payment methods, including:

- Cards: Visa, Mastercard, American Express

- Digital wallets: PayNow, GrabPay, ShopeePay, Apple Pay, Google Pay

- Buy Now, Pay Later: PayLater by Grab, SPayLater, ShopBack PayLater, Atome

- Others: UnionPay, WeChat Pay, Alipay, and UPI (for Indian consumers)

How easy is it to set up?

Hitpay offers plugins for Shopify, WooCommerce, and Magento, as well as robust APIs. For businesses without a website, they provide payment links and recurring billing options. Many integration options require no coding knowledge, making it accessible for SMEs.

Is it secure?

Hitpay is PCI DSS compliant and uses advanced encryption, 2-Factor Authentication, and Transport Layer Security. They’ve partnered with Stripe for enhanced fraud detection and use tokenization to protect sensitive data.

What about support?

Support is available via email and WhatsApp, and they provide self-serve guides. User reviews generally praise their user-friendly interface and strong customer support.

How do I get my money?

Hitpay offers next-day payouts directly to business bank accounts and supports various local payment networks, including FAST in Singapore. For SGD payouts, they provide free local transfer options.

Airwallex in Focus

What’s the story with Airwallex?

Airwallex has its global headquarters in Singapore and is licensed by the Monetary Authority of Singapore as a Major Payment Institution. They’ve seen significant growth, with a 153% year-on-year revenue increase for FY2024. Their website is airwallex.com/sg/.

The costs

For domestic cards and wallets (Visa, Mastercard, AmEx, Apple Pay, Google Pay), Airwallex charges 3.30% + 0.50 SGD per transaction, with an additional 0.3% for international cards. Local payment methods cost 0.50 SGD plus a variable Payment Method Fee. Subscription management incurs a 0.40% fee per successful card transaction. They offer zero setup, maintenance, or hidden fees.

What currencies can I use?

Airwallex is a standout for currency support. Their Global Accounts feature allows businesses to receive funds in over 20 currencies, including USD, EUR, GBP, AUD, and many Asian currencies. They also offer a multi-currency wallet supporting over 23 currencies and facilitate global transfers to over 150 countries.

What payment methods do they accept?

They support major card networks (Visa, Mastercard, AmEx, UnionPay), digital wallets (Apple Pay, Google Pay), and over 160 local payment methods including WeChat Pay and GrabPay.

How easy is it to set up?

Airwallex offers both no-code solutions (Checkout, Payment Links) and plugins for Shopify, WooCommerce, and Magento. For more complex needs, they provide powerful APIs for custom solutions. This range accommodates businesses with varying technical expertise.

Is it secure?

Airwallex is compliant with PCI DSS, SOC1, and SOC2 requirements. They implement 24/7 monitored security controls, fraud prevention features, and advanced liveness checks during onboarding.

What about support?

They offer a comprehensive help center with a blog and detailed FAQ section. While they don’t currently have live chat support, they provide dedicated account managers for business clients and technical support staff.

How do I get my money?

Airwallex facilitates fast global transfers and offers free local transfers within their network. A key advantage is their like-for-like settlement in multiple currencies, allowing businesses to receive payouts without currency conversion fees.

The Scoop on Stripe

What’s Stripe all about?

Stripe is a globally recognized payment gateway supporting millions of companies worldwide. Their Singapore-specific website is stripe.com/en-sg/.

The costs

For domestic cards, Stripe charges 3.4% + S$0.50 per transaction, with an additional 0.5% for international cards. Digital wallet fees vary: standard card rates for Apple Pay and Google Pay, 3.3% for GrabPay, and 2.2% + S$0.35 for WeChat Pay and Alipay. PayNow transactions cost 1.3%. Additional fees apply for services like Instant Payouts (1%), Disputes (S$15.00), and Stripe Tax (0.5%).

What currencies can I use?

Stripe supports payments in over 135 currencies and facilitates cross-border selling to over 195 countries. They offer multi-currency settlement and adaptive pricing to help manage international transactions.

What payment methods do they accept?

Stripe accepts major card networks (Visa, Mastercard, AmEx, UnionPay, JCB), digital wallets (Apple Pay, Google Pay, Alipay, WeChat Pay, GrabPay), and local bank transfers via PayNow. In total, they support over 100 payment methods globally through a single integration.

How easy is it to set up?

Stripe offers Payment Links (no-code), Checkout (prebuilt payment form), and Elements (UI components). Their powerful APIs allow for highly customized payment flows, and they provide plugins for popular e-commerce platforms like Shopify and WooCommerce. Their extensive documentation and testing tools make integration easier for developers.

Is it secure?

Stripe is PCI DSS compliant and employs comprehensive security measures, including data encryption. Their fraud prevention system, Radar, uses machine learning to decrease fraud and improve authorization rates.

What about support?

Stripe offers support channels for sales inquiries, general help, and resources for media and press. They provide extensive documentation and a developer dashboard for technical users. Enterprise clients receive priority support. Reviews suggest mixed experiences with direct customer service, but their documentation is generally well-regarded.

How do I get my money?

Stripe offers unified payout options for online and in-person payments. Businesses can choose standard payout schedules or opt for Instant Payouts (for a fee). The Stripe Dashboard provides a comprehensive interface for managing payments and tracking payout status.

The PayPal Picture

What’s PayPal all about?

PayPal is a globally recognized brand with a substantial user base. They offer distinct account options for personal, small business, and enterprise users. Their Singapore website is paypal.com/sg/.

The costs

PayPal’s fee structure is complex and tiered based on monthly transaction volume. It includes fees for domestic and international transactions, fixed fees based on currency (S$0.50 for SGD), and additional charges for services like Online Card Payment Services, Payouts, Chargebacks, Disputes, Currency Conversions, and Withdrawals.

What currencies can I use?

PayPal supports a wide range of currencies for global transactions and offers multi-currency accounts for managing funds in different currencies.

What payment methods do they accept?

PayPal allows customers to pay using their PayPal accounts, linked bank accounts, or credit cards. They support major cards like Visa, Mastercard, Discover, and AmEx, as well as digital wallets such as GrabPay, Alipay, Apple Pay Web, and WeChat Pay.

How easy is it to set up?

PayPal offers various integration options, including PayPal Complete Payments (for online checkout and invoicing), PayPal.Me (for personalized payment links), and more traditional options like Website Payments Standard and Pro. PayPal Checkout provides a streamlined payment experience for online customers.

Is it secure?

PayPal offers 24/7 fraud monitoring, seller and buyer protection policies, data encryption, and adheres to PCI compliance standards.

What about support?

PayPal provides a Help & FAQ section and various contact options. User reviews suggest reaching a live agent can sometimes be challenging, and experiences with fraud handling and account holds can vary.

How do I get my money?

Businesses can receive payments via PayPal.Me links and withdraw funds to bank accounts (free for SGD withdrawals above S$200, S$1.00 fee for amounts below S$200), to US bank accounts (3.00% fee), or to cards (1% fee, min S$0.50, max S$15.00). Currency conversions during withdrawals incur additional fees.

So, Which One’s Right for You?

Below is a comparison table:

| Feature | Fiuu Pay (formerly RMS) | Hitpay | Airwallex | Stripe | PayPal |

| Signup URL (SG) | fiuu.com | hitpayapp.com/sg/ | airwallex.com/sg/ | stripe.com/en-sg/ | paypal.com/sg/ |

| Transaction Fees (Key highlights for SG) | Tiered (Lite & Premium), % of turnover, by default is 2.8% without a fixed 0.5 fee | Pay-per-transaction, varies by method (e.g., 2.8% + S$0.50 for domestic cards) | 2.8% + 0.50 SGD for domestic cards, variable for local methods | Varies by method (e.g., 3.4% + S$0.50 for domestic cards), additional fees | Tiered (Lite & Premium), % of turnover, by default us 2.8% without a fixed 0.5 fee |

| Supported Currencies (Key highlights) | SGD, PHP, IDR, VND, THB, AUD, DKK, CHF, USD, MYR, SEA focus | 150+ currencies, strong APAC support | 20+ receive, 23+ wallet, 150+ transfer | 135+ currencies, global reach | Numerous, inferred from fee tables, multi-currency accounts available |

| Accepted Payment Methods (Key highlights for SG) | Cards, Internet Banking (PayNow), E-wallets (GrabPay, ShopeePay), BNPL, Crypto | Cards, PayNow, GrabPay, ShopeePay, Apple/Google Pay, BNPL, QR, UPI | Cards, Apple/Google Pay, 160+ local methods (WeChat Pay, GrabPay) | Cards, Apple/Google Pay, GrabPay, WeChat/Alipay, PayNow, others | PayPal, Cards, APMs, Digital Wallets (GrabPay, Alipay), Bank Transfers |

| Integration Options (Key highlights) | Seamless, Plugins (Shopify, woocommerce, and SiteGiant), APIs, Mobile XDK | Plugins (Shopify, WooCommerce, Magento), APIs, Payment Links, Recurring Billing | Checkout, Plugins, Payment Links, APIs, No-code/Low-code options | Payment Links, Checkout, Elements, Powerful APIs, Extensive documentation | PayPal Checkout, PayPal.Me, APIs, Website Payments Standard/Pro |

| Security Measures (Key highlights) | PCI DSS Level 1, ISO 27001:2022, Tokenization, Low dispute ratio | PCI DSS compliant, Advanced encryption, 2FA, TLS, Tokenization, Fraud detection by Stripe | PCI DSS, SOC1, SOC2, 24/7 monitoring, Fraud prevention, Liveness checks | PCI DSS compliant, Data security & encryption, Regulatory licenses, Radar fraud prevention | Secure platform, 24/7 fraud monitoring, Buyer/Seller protection, Data encryption, PCI compliant |

| Customer Support (Key highlights) | Email, Dedicated account managers, contact Singapore distributor +65 8733 7266 for tiered pricing | Email, WhatsApp, Self-serve guides, Generally praised support | Help center, Dedicated account manager, Technical support | Comprehensive documentation, Developer support, Mixed user reviews | Help & FAQ, Contact options, Mixed user reviews |

| Payout Options (Key highlights) | daily/weekly settlement, can contact Singapore distributor +65 8733 7266 for tiered pricing | Direct bank transfer, Payout APIs (FAST), Next-day, Free local SGD transfer | Fast, cheaper global transfers, Free local, Like-for-like multi-currency settlement | Unified online/in-person, Instant (fee), USD (fee), Unified dashboard | PayPal.Me, Bank account (fees may apply), Cards (fees apply), US Bank account (fee) |

The best payment gateway depends on your specific business needs:

- For startups and SMEs: Fiuu and Hitpay stands out with its user-friendly interface, transparent and lower pricing, and no-coding integration options.

- For high-volume businesses: Fiuu, Stripe or Airwallex offer custom pricing that could save you money as you scale.

- For Southeast Asian focus: Fiuu Pay or Hitpay excel with their strong regional payment method support.

- For global reach: Airwallex and Stripe offer excellent multi-currency support and international capabilities.

- For brand recognition: Fiuu, Stripe, and PayPal’s established reputation and large user base can boost customer confidence.

- For developer-friendly tools: Stripe leads the pack with its comprehensive APIs and customization options.

Remember, the right choice involves looking at security, ease of integration with your systems, customer support quality, and which payment methods your customers prefer to use.

Consider piloting different gateways to find the perfect fit for your unique business needs. The digital payment landscape in Singapore continues to evolve with digital wallets, cross-border solutions, embedded finance, and real-time payment capabilities shaping the future.

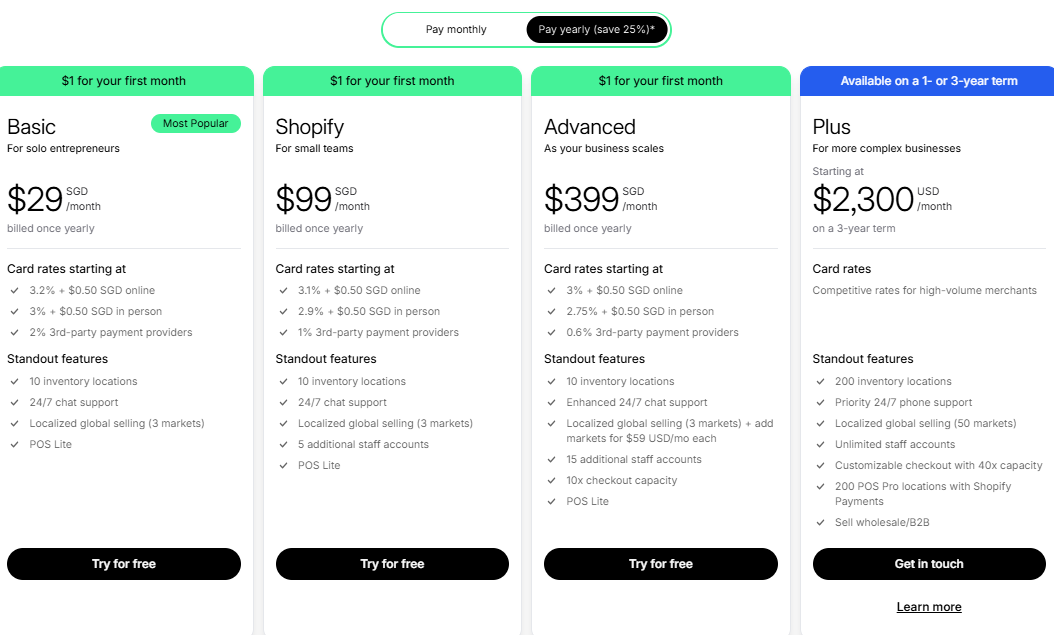

]]>The usual outcome would normally end with deciding on the up-most important choice, Shopify or Shopify Plus.

Although both platforms are well known to have sturdy foundation, Shopify Plus more well known to be a platform specifically designed to maintain high volume and high growth from enterprises or businesses of all sizes.

The moment when you decide to use the wrong platform fo your business, the consequences of your actions will be costly and perhaps even lead to the downfall of the business.

In this article, we will be taking a comprehensive look of the analysis between the differences of Shopify and Shopify Plus.

While taking into account of vital factors such as pricing, features that exist, workability of the two and finally, discussing the target audiences of the two, whether it be a business or a enterprise.

Shopify:

Shopify is a well-known leading E-Commerce platform that helps businesses of all sizes to easily create and manage various online stores.

Shopify offers user-friendly interfaces with a extensive range of features and a wide variety of apps and all sorts of integrations.

Shopify is easily accessible and has a comprehensive functionality, making it a well favored choice for businesses alike, especially for those businesses who are seeking to expand their online presence.

By the end of this article, you will have a proper educated understanding of which platform best fits your business’s goals and will allow you to topple the rest of the competition.

Shopify Plus:

Shopify Plus is well known to be used by enterprise-level businesses, this version of Shopify has been specifically designed to cater businesses and brands unique requirements of various industries.

Offering a wide variety of features and capabilities, making it a perfect choice for businesses with thriving sales, intricate operations and having a powerful demand for more control and flexibility.

This provides a versatile and customizable platform that will be able to handle the difficult demands of quickly expanding businesses, all while also offering a dedicated support with a broad range of premium features that are normally not seen on the standard Shopify subscription.

Differences of Shopify VS Shopify Plus

Features | Shopify | Shopify Plus |

|---|---|---|

| Price | A fixed subscription monthly fee. Ranging from 29SGD to 399SGD | Subscription based, 1-Year Term to 3-Year Term. Ranging from 2300USD to 2500USD |

Audience |

|

|

| Versatility | Can be used by almost all businesses to an extent. | Designed to mostly enhance big businesses and help manage some growth. |

Customizability |

|

|

Support Services |

|

|

Platform Functionalities |

|

|

Shopify VS Shopify Plus: Vital Features & Why are they crucial

Whenever you are deciding which is the right E-commerce platform that best suits you, there is a critical choice needed to be made in any business or enterprise.

In this section, we will dive into the most crucial features when you are deciding to choose between Shopify and Shopify Plus.

We’ll be taking a comprehensive look into important factors such as the price, the target audience, how customizable they are and finally what kind of support services are provided in both Shopify and Shopify Plus.

These factors could directly affect your abilities to either achieve your business goals, enhancing your operations or even affecting your success in the competitive E-commerce market.

Price:

When you are consider to start with anything, especially with Shopify and Shopify Plus, Price is one of the first things that come into mind.

Shopify would offer similarly tiered pricing plans with slightly more features at higher prices, making it a good choice for businesses that have flexible budgets.

Shopify Plus on the other hand, uses a subscription-based model which are priced according to your business’s or enterprise’s MRR or Monthly Recurring Revenue.

This approach could be a more cost-effective plan for rapidly growing businesses with the cost sales also increasing with your business’s or enterprise’s revenue.

So in this section of the article, we will be diving into the pricing models of both Shopify and Shopify Plus.

We will be taking at peek at Shopify’s tiered pricing plans as well as Shopify Plus’s subscription-based models and will be analyzing how their pricing could impact your expenses and profitability.

Shopify:

Shopify offers a variety of plans at scaling prices, all of them are designed to cater small to medium sized businesses. Each of these plans can provide a variety of features, such as customization and support, this can impact a business in the way it operates or scales.

- Basic: The perfect plan for solo entrepreneurs, this plan would provide basic essential E-commerce features such as website building tools, product listing, simple reports and are given access to simple app integrations. It maintains a low operational cost which would limit advanced customization and automation, however this is a great option for Solo Entrepreneurs or extremely small businesses.

- Standard: This plan is meant for businesses in the midst of growth, this plan will be offering more advanced tools and features, including professional reports, 5 additional staff accounts and have lower transaction fee. It can directly support a business expansion as it can provide valuable insights and the operational efficiency of the business.

- Advanced: This plan has been tailor-made for large businesses or enterprises, this plan will include the following features: Advanced Reports, Custom pricing for markets and Lower Credit Card fee. With this, enhanced analytics and a better customization, these two will definitely support in the international growth and the data-driven decisions in the business or enterprise.

Shopify Plus:

Shopify Plus offers a fairly high initial pricing model with much customizable options, all catered to develop businesses for rapid growth, enterprise-level businesses.

Unlike the standard Shopify plans with their fixed prices, Shopify plus will always start with at least $2300 a month which then can be scaled based on the business’s sale volume, customization requirements and how complex the operations are.

For businesses that generate exceptionally high revenue, the prices may change to be a revenue-based model, this are typically around the 0.25% of the business’s monthly sales that surpasses the threshold.

Due to Shopify Plus’s custom price model, we will take a look at how their price could potentially affect businesses:

Initially High Investment:

The initial starting cost are definitely much more than the standard, fixed Shopify plan prices, this can be a substantial price to pay for some businesses.

Despite this, the investment can be used to gain access to an enterprise-level features that can significantly aid the overall growth and operational efficiency.

Some of these features would be:

Less Transaction & Payment fees

- The transaction fee are reduced more compared to the other plains found on any of the lower tiered plans, this especially to payments done through Shopify Payments.

- This will definitely save costs and provide a positive impact to the business’s profit margin, especially for the high-volume sales.

Next-Level Customization & Automation

- Shopify Plus will contain features such as customized checkout experiences, Shopify Flow, which is the automation, and a Script Editor, these will help businesses create a more smooth operation and enhance the overall customer engagement.

- These features and tools will dramatically improve the overall conversion rates, retention of customers and the overall operational efficiency, this justifies the higher cost between Shopify and Shopify Plus.

Versatility & Global Expansion

- Shopify Plus aids businesses to create multi-store managements, global selling and local customer experience.

- Businesses now can seamlessly expand themselves into new markets without needing to worry about needing to invest into separate systems, this will accelerate the overall international business’s growth.

Devoted Support & Quicker Problem Resolution

- Shopify Plus provides priority support and devoted Launch Engineer, businesses and enterprise-level businesses can both receive valuable insights from experts and gain guidance during both setup and the scaling.

- This will reduce the downtime while enhancing the issue resolution and will lessen the overall risk of having costly disruptions of operational functions.

Customizable Prices

- Shopify Plus has versatile pricing model which will ensure business’s overall growth in line with their revenue.

- Despite the ever-growing brands, the overall value of these state-of-the-art tools and framework both will overcome the overall cost.

The Impact on the Business:

Despite Shopify Plus’s high considerable investment, Shopify Plus will be able to greatly aid businesses with high volume sales or have aspiring growth goals.

By harnessing these advanced features, you can easily manipulate the market by using its automation tools, dedicated support, sales increase, upgraded efficiency and ascend rapidly.

This acquisition will bring in strong returns by minimizing the operational congestions while also releasing new sale channels and overall, enhancing the business’s growth.

Target Audience:

When deciding whether or not to use Shopify or Shopify Plus, you also need to know who could benefit the most from either platforms.

The reason behind this is because if you choose the wrong platform, you may not be able to use everything within the platform at its best and most of its features may not even benefit your business in the slightest.

In addition to that, by choosing the wrong platform, it may cost you heavily and prevent you from achieving your business’s goals.

So we will take a look at what kind of businesses and what kind of individuals could benefit the most from Shopify and Shopify Plus.

Shopify:

Shopify has been specifically created to cater enthusiasts and businesses who are looking for user-friendly interface and easily obtainable platform in order to build and overall growth of their online stores.

This would suit a wide variety of users and consumers, ranging from new entrepreneurs or learners who have limited technical expertise and all the way to established businesses who are seeking to expand on their operations.

Shopify provides important E-commerce tools such as its versatile options and slick integrations which aids users to easily evolve their business quickly without needing to have extensive technical knowledge.

- Small to Medium Businesses:

From startups to small or medium sized established businesses who are seeking to widen their presence online. - New Entrepreneurs:

New to the market, these individuals have limited knowledge into the technical expertise who are desperately looking for a way to create a user-friendly platform to build and structure their online stores on. - Businesses looking for easier usage:

Businesses or companies seeking to prioritize the simplicity of their online stores and design it in a way that it would have user-friendly interfaces. - Limited Budgets:

Shopify offers low priced and affordable fixed plans, this allows for more businesses with limited financial sources to create and utilize Shopify’s features. - Businesses working with various industries:

From retail to fashion to even food and beverages, Shopify will suit business across different industries.

Shopify Plus:

Shopify Plus is the perfect platform for large businesses or enterprises who are seeking for an advanced E-commerce platform with excellent capabilities, robust versatility and substantial customization.

This will give enterprises the ability to prioritize their business’s own growth, efficiency and the overall personalization of the brand by allowing them to comprehend their high volume sales, automated processes and provide excellent experiences for customers across various channels.

- High Sale Volume Businesses:

For businesses or enterprises with large amounts of sale volumes and have constantly high traffic peaks, these two will require a strong infrastructure and versatility in order to handle their demands accordingly. - Enterprise Businesses:

From Large to Massive organizations who are actively looking to take advantage of state-of-the-art features, global presence and have tailor-made integrations to streamline their E-commerce workflow. - Flourishing Brands:

Swiftly expanding to the direct-to-consumer or directly to omnichannel brands who are in need of automation and overall efficiency in operation to maintain its growth. - Multi-Regional & Global Sellers:

For Companies or Enterprises swelling internationally, needing multi-store management systems, local prices and have multi-language support in order to pierce the markets. - Business-to-Business & Wholesale Businesses:

Enterprises who are keen to selling to other businesses, by taking the advantage of custom prices, dedicated portals and great discounts to cater wholesale requirements. - Esteemed/Redefined Businesses:

Organizations seeking to transition from old platforms to new platforms, looking out for a versatile and extremely reliable source of solution with the ease of the migration and state-of-the-art capabilities. - Marketing Leaders:

Businesses or Enterprises who offers exquisite, subscription-based or even homemade products that would depend on select experiences or custom solutions in order to differentiate themselves.

Customizability:

When it comes to customizability, it is important to take advantage of the features given to you when you pay to use the platforms.

Doing this will allow your business to use everything included in each platform to is fullest.

We will be taking a look at what some of these features are and what they could do to benefit your brand or business.

Shopify:

- Custom Themes:

Be able to decide from a large range of free themes to premium themes, customize their designs and feel free to match your brand. - Customizable Theme Code:

Take advantage of Shopify Liquid’s specialized language to create state-of-the-art revamps to your own theme’s look, design and overall functionality.- Shopify Liquid: An established language which grants the ability for more control over the design and functionality of your store.

- API Standard: Allow your store’s own applications and services through Shopify’s very own standard API, this will authorize the use of integration using multiple tools of various variety.

- Third-Party Integration: Innovate your extensive ecosystem of third-party apps using Shopify App Store to upgrade your overall store’s functionality.

- Custom Apps: Create or use fully customized built-in apps and add in your unique features and custom functionalities to cater your business’s requirements.

- Wholesale Channels: Manifest a entirely different wholesale store that includes its very own unique prices and have its very own product list catered for its wholesale customers.

- International Pricing: Manage prices for various customers that come from various countries or regions based on their local currencies.

Shopify Plus:

Shopify Plus includes all of the features found in the standard Shopify fixed-priced plans with the addition of even more versatility and includes even more exclusive features not found in the already existing set of features in standard Shopify.

In addition to this, there are these new, state-of-the-at features you can gain access to in Shopify Plus, this includes:

- Script Editor:

This feature will grant you the power to add in your very own JavaScript code to your store for more customizability, such as adding personalized experiences, interactive elements and adding unique functions. - Shopify Functions:

Demonstrate serverless workarounds all from your store. This advanced logic, integration and overall customization are all done without the need of external servers, this enhancing the overall performance and drastically improving security. - API Unlimited:

Grants authorization to Shopify’s State-Of-The-Art and unlimited API features like calls, allowing for easier integrations with third-party systems, customized apps and complete it all with some innovative business logistics. - Custom Checkout:

Create a different atmosphere for your customer’s checkout experience as it perfectly aligns with your brand. Enchant your checkout experience with your brand’s unique feel, design and overall functionality to prioritize conversion rates. - Dedicated API:

Gain access to Shopify Plus’s very own devoted API, to ensure consumer’s peak performance, optimal reliability and have an overall trust of good security, these are vital for large stores that constantly have high performing integrations and overall sales. - Multi-Store Management:

Organize multiple stores all at once from one dashboard, this will ease up operations and will improve the efficiency and creates a overall centralized view of the entire business. - B2B Custom Tools:

Take advantage of specially designed for managing B2B sales which includes creation of custom quotes, bulking discounts, creating portals for customers and overall create a smooth-running fulfilment of orders for wholesale customers - Shopify Flow:

Fully automate your business’s processes using Shopify Flow to create stunning workflows virtually, engaging tasks such as order fulfilment, inventory management and overall communication with the customers, this will enable giving more valuable time and save up precious resources.

Support Services:

When it comes to support services between Shopify and Shopify Plus there should be a fine line between them.

Shopify by itself supplies their consumers with the basic and general support features, just to suffice the consumer’s own enquiries and most technical supports.

Shopify Plus on the other hand has a much wider range of support services, from specialized support teams to priority support channels.

We will take a look at Shopify’s and Shopify Plus’s support services and channels, as well as what more Shopify Plus has to offer over Shopify.

Shopify:

Shopify provides basic support services for merchants or entrepreneurs to get answers to their enquiries and give them the necessary information they need to achieve what they need.

Shopify support services would include Email and online Chatting support available 24/7, Phone-Dial support for higher plans, devoted Help Centre, gain access to the support community forums and have the educational resources from Shopify Academy.

This versatile support system targets to qualify merchants with the needed knowledge and overall assistance in order to easily navigate through Shopify and manage to grow their businesses.

The current support services Shopify provides to consumers are as follows:

- Email & Chat:

Contact support via Emails or Chats online when pondering for assistance or any needed support you may ever encounter while using Shopify, this service are available 24-Hours a day. - Phone Dial:

Phone Dials are available if you have paid for a higher priced plan as this form of service can be instant and provides personalized assistance coming from Shopify’s very own dedicated customer service team. - Support Centre:

Explore Shopify’s very own online resource-rich place where you can find valuable articles, guides and even tutorials which could aid users answer their questions when possible, this will usually cover a large range of topics all related and referring over to Shopify’s very own platform. - Community Forums:

The place where you can discover and interact with various kinds of merchants from all kinds of industries, share your experiences, tips and any form of solutions for common challenges faced within Shopify. - Shopify Academy:

Gain the knowledge from free online courses and rich resources all specifically made to help users learn more in-depth about E-commerce, ways to improve their E-commerce Stores and how they can transform their business into success.

Shopify Plus:

While standard Shopify provides the basic needs from support services for merchants and entrepreneurs, Shopify Plus will be providing the same support services found in the standard Shopify plans with more priority and features, mainly for the Help Centre, Community Forums and the Shopify Academy.

In addition to this, Shopify Plus comes with additional support services to further aid consumers in a wider range of dedicated services such as Troubleshooting and Migration support.

- Troubleshooting Support:

Whenever any issues occurs and it is related to technical or operational flaws, Shopify Plus offers a fast and reliable support service to solve those issues. This service provides Shopify Plus consumers with priority support from Experts and will minimize the disruption caused within business operations. - Integration Support:

Get valuable knowledge and resources from Experts to easily connect Shopify Plus over to third-party apps, tools and systems such as ERP, CRM or even marketing platforms. This service allows for a smooth integration across businesses in order to maintain fast and efficient workflows and improve the overall functionality. - Custom Technical Support:

A fully personalized service tailored for businesses that have unique technical requirements, some of these unique requirements would include, implementing customizations or management of complex systems. Shopify Plus enhances their consumer’s experience by providing proficiency in giving solutions and support for challenges to ensure the up-most platform optimal performance. - Migration Assistance:

This service helps businesses to help transition their stores from one E-commerce platform over to Shopify Plus, this would include the transfer of the system, store data, setup and the whole database linked to the store over to Shopify Plus. Doing tis will allow for a streamlined process during migration with minimal disruption and preserving the continuity of the business or brand. - API Support:

By signing onto Shopify Plus, you will be able to access their very own devoted support solely for all enquires or problems regarding API. This will aid businesses to easily construct custom apps, automation of workflows and develop integrations smoothly. This support service will benefits businesses as they can take full advantage of Shopify’s full capabilities as a whole in order to achieve their business’s goals.

Shopify VS Shopify Plus: Which is best for you?

When making the decision of choosing between Shopify and Shopify Plus, the final decision may be overwhelming.

When are going to select which of these two platforms you need to first identify what kind of business you are managing or working in.

These two platforms could severely impact your business as a whole as Shopify standard is known for at most medium-sized businesses, whereas Shopify Plus is catered for Enterprise-Level Businesses.

You should also consider these questions before you make your final decision:

- What are your current estimate of Sales?

- To what extent do you need for control over your store’s functionality and overall design?

- How much is your budget?

- What are your Long-Term Business Goals during its growth?

- Does your business’s requirements need state-of-the-art features?

Small to medium businesses, those just starting out or have a small to limited budget:

- Shopify would be the best choice. Shopify by itself is already affordable and provides a wide range of features and have some of the most user-friendly interfaces of all E-commerce platforms on the market.

Enterprise-Level Business or High Profit Businesses:

Shopify Plus would be the best choice. Shopify Plus allows businesses to have a versatile, large range of advanced features and much needed dedicated support to ensure growth for complex business operations.

All-in-all, the perfect way to justify which of these platforms is the best for you will all come down to what your specific requirements are and what are the priorities of your business.

By taking into account between the two platforms of their prices and what kind of benefits they provide, you may have to first try out their free trials before using up your expenses unnecessarily. Check out more articles like this one on Vue Digital Signage: Shopify VS Shopify : Ultimate Showdown!

]]>Table of Contents

Introduction to Interactive Whiteboards

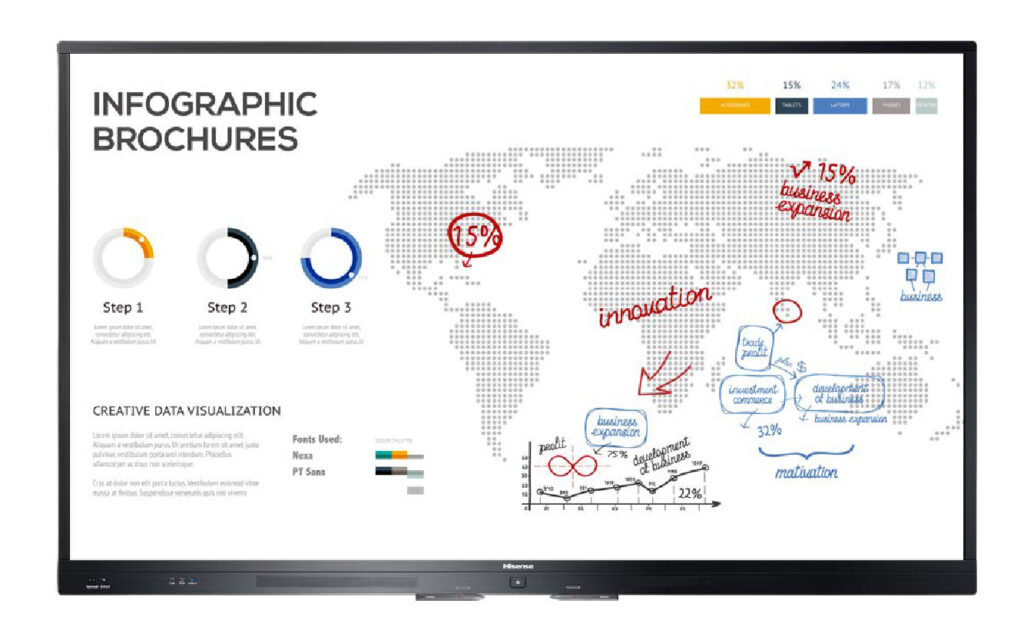

Interactive whiteboards, often referred to as digital whiteboard or smart boards, represent a revolutionary advancement in educational and professional technology. By seamlessly integrating the tactile experience of traditional whiteboards with the dynamic capabilities of digital devices, interactive whiteboards empower users to engage with content in a highly interactive and immersive manner.

Through touch, gestures, or specialized styluses, users can manipulate digital content, annotate presentations, and collaborate in real-time, making them indispensable tools for modern classrooms, boardrooms, and training environments. With their ability to facilitate dynamic presentations, foster collaboration, and enhance learning experiences, interactive whiteboards are reshaping the landscape of interactive teaching and communication.

Types and Features of Interactive Whiteboards

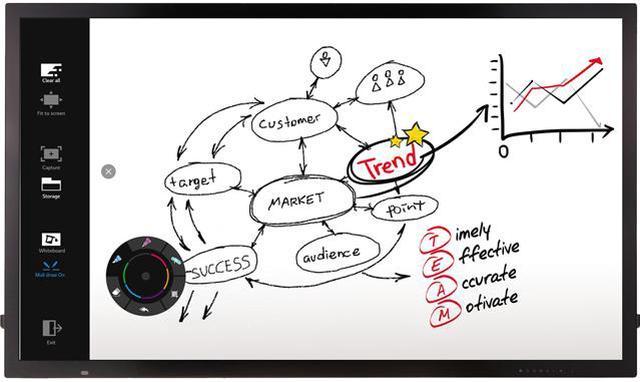

Interactive whiteboards come in various types, including touch-sensitive, pen-based, and hybrid models. Touch-sensitive whiteboards allow users to interact directly with the surface using touch gestures, while pen-based whiteboards provide precise control and annotation with a stylus.

Hybrid whiteboards combine both touch and pen input options, offering versatility for different user preferences. Advanced features such as multimedia integration and connectivity options further enhance their usability in educational and professional environments.

These interactive tools facilitate dynamic presentations, collaborative brainstorming sessions, and engaging learning experiences. With their ability to accommodate diverse teaching styles and foster active participation, interactive whiteboards have become indispensable tools for educators, presenters, and professionals seeking to enhance communication and collaboration in today’s digital age. If you want to explore more about the different types of interactive whiteboards available and their features, check out our comprehensive guide on the topic.

Utilizing Interactive Digital Whiteboards for Enhanced Learning

Interactive whiteboards empower educators to create dynamic presentations, facilitate collaborative activities, conduct interactive quizzes, and provide immersive learning experiences. By incorporating multimedia elements such as images and videos, educators can capture students’ attention and reinforce key concepts. Additionally, interactive whiteboards enable real-time collaboration among students, fostering teamwork and communication skills.

Through interactive quizzes and assessments, educators can gauge student understanding and provide personalized feedback. Whether through virtual field trips or interactive simulations, educators can leverage the interactive capabilities of whiteboards to foster collaboration, creativity, and active participation in the classroom. If you’re interested in exploring how interactive whiteboards can enhance your teaching environment, our editor’s pick is Hikvision interactive whiteboard, which has the most advanced hardware and attractive software features.

Enhancing Workplace Collaboration with Interactive Digital Whiteboards

Interactive digital whiteboards are revolutionizing collaboration in professional settings by empowering teams to conduct dynamic presentations, facilitate interactive discussions, and brainstorm ideas with unprecedented ease. These cutting-edge tools seamlessly integrate multimedia elements and real-time collaboration features, transforming traditional meetings into immersive and engaging sessions that enhance productivity and creativity.

With interactive whiteboards, employees can annotate documents, share ideas, and collaborate on projects in real-time, regardless of their physical location. Moreover, the versatility of interactive whiteboards extends beyond in-person meetings to remote work scenarios, where they serve as indispensable tools for conducting virtual meetings and presentations.

In today’s globalized and distributed workforce, remote collaboration is essential for maintaining productivity and fostering team cohesion. Interactive whiteboards facilitate remote collaboration by offering features tailored to virtual meetings, such as screen sharing and video conferencing integration. This enables distributed teams to communicate seamlessly, share ideas, and collaborate on projects in real-time, bridging geographical barriers and maximizing productivity.

Furthermore, the transformative potential of interactive digital whiteboards extends beyond facilitating collaboration to driving innovation and inclusivity within organizations. By providing a platform for brainstorming and idea generation, interactive whiteboards empower employees to contribute creatively to problem-solving and decision-making processes.

This fosters a culture of innovation where diverse perspectives are valued, and ideas are freely exchanged, leading to breakthrough solutions and competitive advantages. Additionally, interactive digital whiteboards play a crucial role in promoting inclusivity within organizations by providing accessible and inclusive collaboration tools.

With features such as accessibility options for users with disabilities and language translation capabilities, interactive whiteboards ensure that all team members can participate fully in meetings and discussions, regardless of their individual needs or backgrounds. This promotes diversity, equity, and inclusion within the workplace, fostering a sense of belonging and collaboration among team members.

Interactive Digital Whiteboards: Driving Innovation in Research and Development

Interactive digital whiteboards are revolutionizing research and development (R&D) environments by providing dynamic platforms for teams to brainstorm ideas, visualize concepts, and collaborate on projects with unparalleled efficiency.

These cutting-edge tools serve as versatile canvases for capturing and refining ideas, enabling teams to sketch out designs, map workflows, and annotate data in real-time, fostering a culture of innovation and experimentation.

With features like remote collaboration capabilities, interactive whiteboards allow teams to collaborate seamlessly across geographic locations, leveraging multimedia elements such as images, videos, and interactive simulations to enhance visualization and accelerate the ideation process.

Furthermore, interactive digital whiteboards facilitate effective communication and idea sharing among team members, enabling them to articulate complex concepts and garner valuable feedback from stakeholders.

By providing a dynamic and immersive collaboration environment, these innovative platforms inspire creativity and promote interdisciplinary collaboration, leading to breakthrough innovations and transformative discoveries.

As organizations continue to invest in R&D, interactive digital whiteboards stand as indispensable tools for fostering a culture of innovation and driving sustainable growth. In essence, interactive digital whiteboards are not just technological tools; they are catalysts for driving innovation and shaping the future of research and development across diverse industries and disciplines.

Disclaimer: The following information is sourced from Vue Digital Signage, and we do not claim ownership of the content.

In a comprehensive Beyond the Whiteboard: Discover the Power of Smart Interactive White board by Vue Digital Signage, various features and specifications were evaluated. According to their findings. This comparison underscores the importance of choosing the right interactive whiteboard for your needs. You can explore the full comparison on Vue Digital Signage’s website: Beyond the Whiteboard: Discover the Power of Smart Interactive White board

]]>In the ever-evolving landscape of education and professional environments, the tools we use to communicate and collaborate play a crucial role in shaping how we teach, learn, and work.

At the heart of this transformation is the age-old debate between traditional whiteboards and their technologically advanced counterpart: interactive whiteboards. As schools and offices navigate the decision between these two options, it’s essential to explore the trends, benefits, and drawbacks associated with each.

From fostering engagement in classrooms to enhancing productivity in boardrooms, understanding the evolving preferences and applications of these tools is vital for creating dynamic learning and working environments. Join us as we delve into the comparative analysis of interactive whiteboards versus traditional whiteboards, uncovering the trends that are reshaping educational and professional landscapes.

Table of Contents

Overview of Whiteboard Technologies

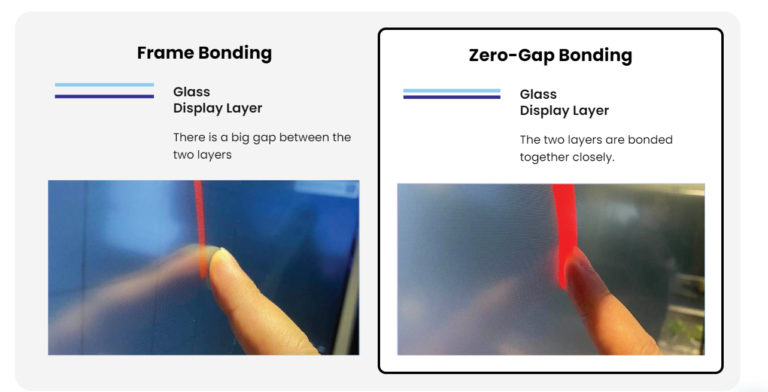

Whiteboard technologies have long been a staple in both educational and professional settings, serving as versatile tools for visual communication and collaboration. Traditional whiteboards, typically composed of a glossy white surface, are used with dry-erase markers, allowing for the quick jotting down of notes, diagrams, and ideas.

On the other hand, interactive whiteboards represent a more recent innovation, integrating digital capabilities such as touch-screen interfaces, interactive software, and connectivity with other devices. These advancements enable users to engage in interactive presentations, manipulate digital content, and access a myriad of educational resources with just a touch. As technology continues to advance, the landscape of whiteboard technologies evolves, presenting users with a range of options to suit their specific needs and preferences. If you’re interested in exploring our latest innovations in interactive whiteboard technology.

Advantages of Traditional Whiteboards

Traditional whiteboards offer several advantages that have solidified their presence in classrooms and offices worldwide. Firstly, they are simple to use and require minimal setup, making them accessible to users of all technological proficiencies.

Their low cost and ease of maintenance make them a cost-effective solution for institutions with budgetary constraints. Additionally, traditional whiteboards promote real-time interaction and collaboration, as users can easily write, erase, and modify content during discussions or brainstorming sessions.

Moreover, their tactile nature provides a tangible medium for creativity, allowing users to sketch diagrams, equations, or illustrations with ease. Finally, traditional whiteboards do not rely on electricity or complex software, ensuring reliability and uninterrupted use even in areas with limited technological infrastructure. These advantages highlight the enduring appeal and practicality of traditional whiteboards in various educational and professional environments.

Advantages of Interactive Whiteboards

Interactive whiteboards represent a significant leap forward in visual communication and collaboration, offering a multitude of advantages over traditional whiteboards. Firstly, their interactive capabilities foster engaging and dynamic presentations, allowing presenters to manipulate digital content, annotate slides, and incorporate multimedia elements with ease.

This interactivity enhances audience participation and retention, making lessons and presentations more effective. Additionally, interactive whiteboards often come equipped with specialized software and connectivity options, enabling seamless integration with other digital devices and online resources.

This facilitates access to a wealth of educational materials, interactive learning modules, and collaborative tools, enriching the learning experience for students and professionals alike. Furthermore, interactive whiteboards can record and save presentations, making it easy to review or share content later.Finally, their versatility and adaptability make them suitable for various teaching styles, learning environments, and professional applications, positioning them as indispensable tools in modern classrooms and boardrooms.

Workplace Dynamics: Whiteboard Trends in Professional Arenas

In professional arenas, the utilization of whiteboard technologies reflects the evolving dynamics of workplace collaboration and communication. Traditional whiteboards, despite their simplicity, continue to hold significance in boardrooms, conference halls, and collaborative spaces across industries.

Their tactile nature encourages brainstorming sessions, strategic planning, and problem-solving exercises, fostering a sense of teamwork and creativity among colleagues. Moreover, traditional whiteboards offer a versatile platform for visualizing ideas, workflows, and project timelines, facilitating efficient communication and decision-making processes.

However, with the advent of digital transformation, interactive whiteboards are gaining traction in professional settings. These advanced tools enable seamless integration with digital documents, video conferencing systems, and collaborative software, enhancing productivity and remote collaboration capabilities. As workplaces embrace hybrid and flexible work arrangements, the integration of interactive whiteboards into office environments is expected to continue, shaping the future of professional collaboration.

Interactive Whiteboard vs. Whiteboard: Choosing the Right Whiteboard for Your Needs

Here’s a quick comparison to help you decide which whiteboard is best suited for your needs:

| Feature | Whiteboard | Interactive Whiteboard |

| Cost | Medium | Affordable Nowadays |

| Setup | Simple | Slightly more complex |

| Functionality | Basic writing & drawing | Extensive – multimedia, annotation, projection, presentation and many more |

| Interactivity | No | Yes – touch-based and multi-device interaction |

| Content Storage | No (physical notes) | Digital (save & share) |

| Maintenance | Wear and tear | May require maintenance normally comes with warranty |

| Suitability for | Brainstorming, basic presentations | Collaborative learning, presentations, complex planning, multimedia integration, education , multi-person collaboration, virtual/physical meeting |

| Visual Appeal | Encourages physical interaction | Offers wider image /video/PPT based visual options |

| User Experience | Familiar and simple | Can vary depending on model. Branded products with local warranty are recommended |

| Camera Speaker Tracking | No | Yes |

Disclaimer: The following information is sourced from Vue Digital Signage, and we do not claim ownership of the content.

In a comprehensive Interactive Whiteboard vs Whiteboard: The Trend in School and Office by Vue Digital Signage, various features and specifications were evaluated. According to their findings. This comparison underscores the importance of choosing the right interactive whiteboard for your needs. You can explore the full comparison on Vue Digital Signage’s website: Interactive Whiteboard vs Whiteboard: The Trend in School and Office

]]>The workplace landscape has undergone a seismic shift in recent times, catalyzed by the COVID-19 pandemic. Remote work, once a limited practice, has evolved into a transformative force that has reshaped the traditional office environment. As businesses adapted to the challenges posed by the pandemic, the remote work revolution emerged, offering unprecedented opportunities for flexibility, collaboration, and reimagining the way work is conducted. This article delves into the facets of the remote work revolution, exploring its advantages, challenges, impact on businesses, and the potential future of work.

Advantages of Remote Work

- Flexibility and Work-Life Balance: Remote work provides employees with the flexibility to design their workdays to better suit their personal lives. This balance can lead to reduced stress, improved mental health, and increased job satisfaction.

- Expanded Talent Pool: The removal of geographical barriers allows businesses to tap into a global talent pool, enabling them to hire the best-suited individuals regardless of location.

- Productivity Gains: Many employees find that remote work eliminates office distractions, leading to heightened focus and productivity. Additionally, reduced commute times can contribute to increased efficiency.

- Cost Savings: Both employees and employers can experience cost savings associated with commuting, office space, utilities, and related expenses.

- Environmental Impact: With fewer employees commuting, there’s a potential reduction in carbon emissions and a positive impact on the environment.

Challenges of Remote Work

- Isolation and Loneliness: Remote workers may face feelings of isolation due to the lack of face-to-face interactions and spontaneous social interactions found in traditional office settings.

- Communication and Collaboration: While technology facilitates virtual communication, challenges such as misinterpretation of messages and reduced informal communication can impact collaboration.

- Work-Life Boundaries: The lines between work and personal life can blur, leading to potential burnout as employees find it difficult to disconnect from work.

- Lack of Supervision: Remote work requires a high level of self-discipline and self-motivation, which can be challenging for some employees.

- Security Concerns: Remote work introduces new cybersecurity challenges, as employees may use personal devices and networks that might not be as secure as corporate setups.

Impact on Businesses

- Technology Adoption: The remote work revolution has driven the adoption of virtual collaboration tools, video conferencing platforms, project management software, and cloud-based storage solutions.

- Office Space Transformation: Businesses are reevaluating their physical office spaces, considering flexible and hybrid office models that accommodate both remote and on-site work.

- Focus on Outcomes: The emphasis is shifting from monitoring hours worked to evaluating employees based on their outcomes and contributions.

- Talent Acquisition and Retention: Remote work offers a competitive advantage in attracting and retaining top talent, as employees value the flexibility it provides.

Future of Work: Hybrid Models

As businesses navigate the post-pandemic era, hybrid work models are emerging as a potential solution that combines the best of both remote and office-based work. This approach allows employees to split their time between remote work and on-site collaboration. Hybrid models offer benefits like maintaining company culture, fostering teamwork, and addressing the desire for flexibility.

Conclusion

The remote work revolution is a paradigm shift that has redefined the concept of work and the traditional office environment. While challenges exist, the benefits of remote work cannot be ignored. As businesses continue to adapt and evolve, the remote work revolution has paved the way for a more flexible, inclusive, and agile future of work. By embracing technology, reimagining office spaces, and valuing employee well-being, organizations can harness the power of remote work to reshape the modern workplace for the better.

]]>In an era characterized by rapid technological advancements, evolving consumer preferences, and global uncertainties, businesses are facing unprecedented challenges. The ability to adapt to change has become a defining factor in an organization’s success and survival. This article delves into the strategies, mindset, and practices that enable businesses to navigate uncertainty and thrive in today’s dynamic environment.

Agile Business Models: Flexibility in Action

- Embracing Agility: Businesses are moving away from rigid structures and embracing agile business models. Agile organizations can swiftly pivot to address changing market dynamics and customer demands.

- Iterative Approach: Iterative development and constant feedback loops allow businesses to continuously refine products, services, and strategies based on real-time information.

- Cross-Functional Collaboration: Encouraging collaboration among diverse teams fosters innovation and ensures that multiple perspectives are considered in decision-making.

Digital Transformation: Harnessing Technology for Change

- Digitalization of Processes: Businesses are digitizing operations, streamlining workflows, and automating manual tasks to improve efficiency and accuracy.

- Enhanced Customer Experience: Digital transformation enables personalized customer experiences through data-driven insights and omni-channel engagement.

- Data-Driven Decision Making: By leveraging data analytics, businesses gain insights into customer behavior, market trends, and operational performance, guiding informed decisions.

Supply Chain Resilience: Navigating Disruptions

- Diversification: Businesses are diversifying suppliers and adopting multi-tier supply chains to mitigate risks associated with disruptions.

- Demand Forecasting: Advanced demand forecasting techniques, powered by data analysis and AI, help businesses predict shifts in consumer behavior and adjust production accordingly.

- Collaboration with Partners: Close collaboration with suppliers, partners, and logistics providers fosters a more agile response to disruptions.

Customer-Centric Approach: The Heart of Adaptation

- Listening to Customer Feedback: Businesses that actively listen to customer feedback can tailor their offerings to meet evolving needs and expectations.

- Customization and Personalization: Personalized experiences enhance customer loyalty by making consumers feel understood and valued.

- Iterative Innovation: Continuously innovating based on customer feedback ensures that products and services remain relevant and impactful.

Data-Driven Decision Making: Navigating the Unknown

- Real-Time Insights: Data analytics provide real-time insights into market trends, customer behavior, and performance metrics, allowing businesses to make informed decisions.

- Predictive Analytics: Predictive models use historical data to forecast future trends and outcomes, enabling proactive strategies rather than reactive measures.